Self-Employed Car Finance: Everything You Need to Know

A Comprehensive Guide to Getting Approved as an Independent Worker

If you're self-employed, securing car finance might seem like navigating through a maze of paperwork and proof of income requirements - but it doesn’t have to be that hard! With the right approach and understanding of how lenders view self-employed car finance applications, it is absolutely achievable.

For the UK's growing self-employed workforce, having reliable transport is often essential for running a successful business. Whether you're a tradesperson, freelancer, consultant, or small business owner, we've put together this complete guide to help you understand how self-employed car finance works and how to improve your chances of approval. Read on to find out more…

Key Takeaways:

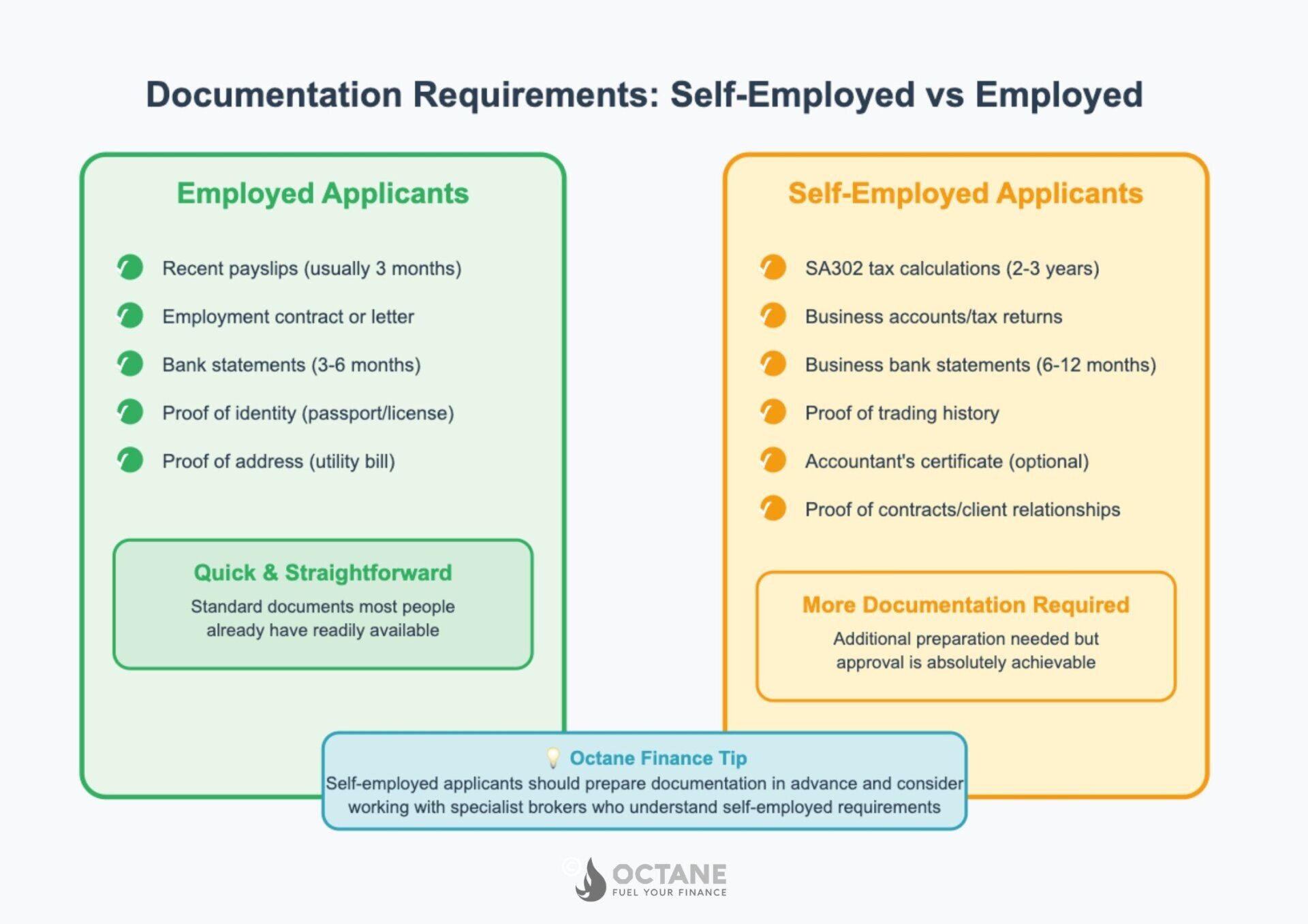

- Self-employed individuals applying for car finance may find the process requires additional documentation compared to those with traditional employment

- Lenders will largely focus on the stability and consistency of your income rather than just its source

- Having at least 1 to 2 years of trading history significantly improves your chances of approval

- A clean credit history, larger deposits, and realistic vehicle choices will strengthen your application

- Working with a specialist broker like Octane Finance can help match you with lenders who understand self-employed circumstances

Can You Get Car Finance if You're Self-Employed?

The simple answer is yes - being self-employed does not disqualify you from getting car finance. However, the application process may be slightly more complex than for those in traditional employment.

What you need to know is that lenders are primarily concerned with your ability to make regular repayments on time. While being self-employed might be perceived as having less stable income than someone with a regular salary, many lenders now recognise that self-employed individuals often have healthy, consistent earnings.

The key difference lies in how you'll need to prove your income and financial stability to potential lenders.

How Does Self-Employed Car Finance Work?

The fundamentals of car finance remain the same whether you're employed or self-employed - you borrow money to purchase a vehicle and repay it over an agreed period with interest. However, the assessment process for self-employed applicants includes some additional considerations. We explain more about this below:

Income Verification

Unlike those in traditional employment who can simply provide payslips as evidence of income, self-employed applicants need to demonstrate their income through alternative documentation. This typically includes the following:

- Tax returns (such as SA100 forms or similar)

- Finalised business accounts

- Bank statements showing regular income

- Evidence of ongoing contracts or client relationships

Trading History

Most lenders prefer to see at least one to two years of trading history. This helps them assess the stability and sustainability of your self-employed income. The longer your business has been established, the more confidence lenders will have in your ability to maintain consistent earnings.

Credit Assessment

As with all finance applications, lenders will review your credit history to evaluate your past financial behaviour. A strong credit score demonstrates responsible borrowing and repayment habits, which can help offset any concerns about self-employed income stability.

Affordability Checks

Lenders will assess whether your proven income is sufficient to cover the car finance repayments alongside your existing financial commitments and living expenses. This ensures that taking on car finance won't cause financial strain.

Types of Car Finance Available to Self-Employed Applicants

Self-employed individuals can access the same car finance options as anyone else, including:

Personal Contract Purchase (PCP)

Personal Contract Purchase car finance is a popular choice due to the lower monthly payments during an agreed period. However, applicants will need to make a larger final 'balloon payment' at the end in order to keep the car. Alternatively, you can return the vehicle or trade it in for a new one. PCP can be useful for self-employed individuals who want to manage cash flow with lower monthly commitments.

Hire Purchase (HP)

Hire Purchase car finance works by you paying a deposit, followed by fixed monthly payments over an agreed term. Once all repayments are made, you own the vehicle outright. This is often a good option for self-employed people who want to eventually own their vehicle.

Lease Purchase (LP)

Lease Purchase car finance combines elements of both leasing and hire purchase. You make fixed monthly payments over the agreement term, but unlike traditional leasing, you have the option to purchase the vehicle at the end for a pre-agreed amount (usually a nominal fee). This can be a particularly attractive option for self-employed individuals who want lower monthly payments than HP but still wish to own the vehicle eventually.

How to Improve Your Chances of Getting Self-Employed Car Finance

To improve your chances of getting approved for self-employed car finance, it’s best to do your research, pre-empt what you need for the application form, and be ready to answer any extra questions the lender may ask. Here’s what we recommend you do:

Prepare Comprehensive Financial Documentation

The more evidence you can provide of stable income, the stronger your application will be. Make sure you gather:

- The last 2 to 3 years of accounts (if available)

- Recent bank statements showing business income

- Tax returns and SA100 forms

- Proof of upcoming contracts or regular clients

Build and Maintain a Strong Credit Score

A healthy credit history is particularly important for self-employed applicants. Before applying, follow these steps:

- Check your current credit report for any errors

- Ensure all bills and existing credit commitments are paid on time

- Reduce outstanding debt where possible

- Register on the electoral roll at your current address (this really does make a difference!)

Save for a Larger Deposit

Putting down a decent deposit on a vehicle (ideally 10% or more) demonstrates financial stability and reduces the lender's risk. This often results in better interest rates and improved chances of approval.

Be Realistic About Your Vehicle Choice

We know it seems pretty obvious, but choosing a vehicle that clearly aligns with your proven income level will help you secure a loan. Applying for finance on an expensive luxury car when your declared profits are modest will raise red flags with lenders.

Consider Using a Guarantor

If your self-employed history is limited or your credit score isn't ideal, having a guarantor with good credit can strengthen your application significantly. Just make sure this person is willing to vouch for you and your business.

Separate Personal and Business Finances

Maintaining a clear separation between personal and business banking demonstrates professional financial management, which lenders will view positively.

Be Transparent About Your Circumstances

Honesty is the best policy when it comes to applying for finance. Be upfront about your self-employed status, income fluctuations, and business prospects. Attempting to hide information will likely lead to rejection, which could damage your current credit score.

Tips for Specific Self-Employed Professions

We appreciate that not all self-employed individuals fall under the same category. To help you in your car finance application process, we’ve put together our top tips for the following:

Tradespeople

If you're a plumber, electrician, carpenter or similar tradesperson, having evidence of regular clients or contracts can be particularly helpful. Consider including testimonials or references from long-term customers so the lender can get a true understanding of you and your business.

Freelancers

Freelancers with variable income should highlight longer-term client relationships and demonstrate average monthly earnings over time rather than focusing on individual payments. Keep a record of all your recent work.

Limited Company Directors

If you operate through a limited company, lenders may consider both your salary and dividends. Have detailed company accounts prepared by an accountant to strengthen your application and help demonstrate professional business operations.

Sole Traders

Sole traders should ensure their tax returns accurately reflect their true income. Some sole traders minimise declared profits for tax purposes, which can unintentionally harm their vehicle finance applications.

Recently Self-Employed

If you've been self-employed for less than a year, lenders may consider your previous employment history. Include details of relevant experience and qualifications that support your business viability.

Access Self-Employed Car Finance

At Octane Finance, we understand the unique challenges that self-employed individuals can face when applying for car finance. Our experienced team specialises in finding suitable finance solutions for self-employed applicants across various industries and circumstances.

As a leading automotive finance broker in the UK, we work with an extensive panel of trusted lenders who have specific expertise in self-employed finance.

We take the time to understand your individual situation and match you with lenders most likely to approve your application on favourable terms. Our industry connections often allow us to secure competitive rates and terms, even for those with complex income structures or less-than-perfect credit.

Contact us today to explore your self-employed car finance options and take the first step towards your new vehicle.

Frequently Asked Questions

Q: How long do I need to be self-employed to get car finance?

A: Most lenders prefer to see at least 1 to 2 years of self-employed trading history. However, some specialist lenders may consider applications from those with shorter histories, particularly if you have a strong credit score or can provide a larger deposit.

Q: Can I get car finance as a self-employed person with bad credit?

A: Yes, it's possible, although your options may be more limited, and interest rates could be much higher. Working with a specialist broker like Octane Finance can help connect you with lenders who specialise in both self-employed applicants and those with credit challenges.

Q: Will I need to provide proof of income for self-employed car finance?

A: Yes, you'll typically need to provide evidence such as tax returns (such as SA100 and SA302 forms), business accounts, and bank statements demonstrating your income. The specific requirements vary between lenders, so always check before applying.

Q: Do I need an accountant to apply for self-employed car finance?

A: While not strictly necessary, having professionally prepared accounts can strengthen your application. Accountant-certified financial statements lend credibility to your income claims and may help overcome some lenders' hesitations about self-employed applicants.

Q: Can I claim car finance as a business expense if I'm self-employed?

A: This depends on how you structure your finances and how the vehicle is used. If the car is used solely for business purposes, you may be able to claim certain expenses. However, for mixed-use vehicles (both business and personal use), only the business proportion can be claimed. We recommend consulting with your accountant for specific tax advice.

Q: Will I pay higher interest rates as a self-employed applicant?

A: Not necessarily. While some lenders might charge higher rates due to the perceived additional risk, if you have good credit and can demonstrate a stable income, you can still access competitive rates. Shopping around or using a broker like ourselves is particularly important to find the best deals.